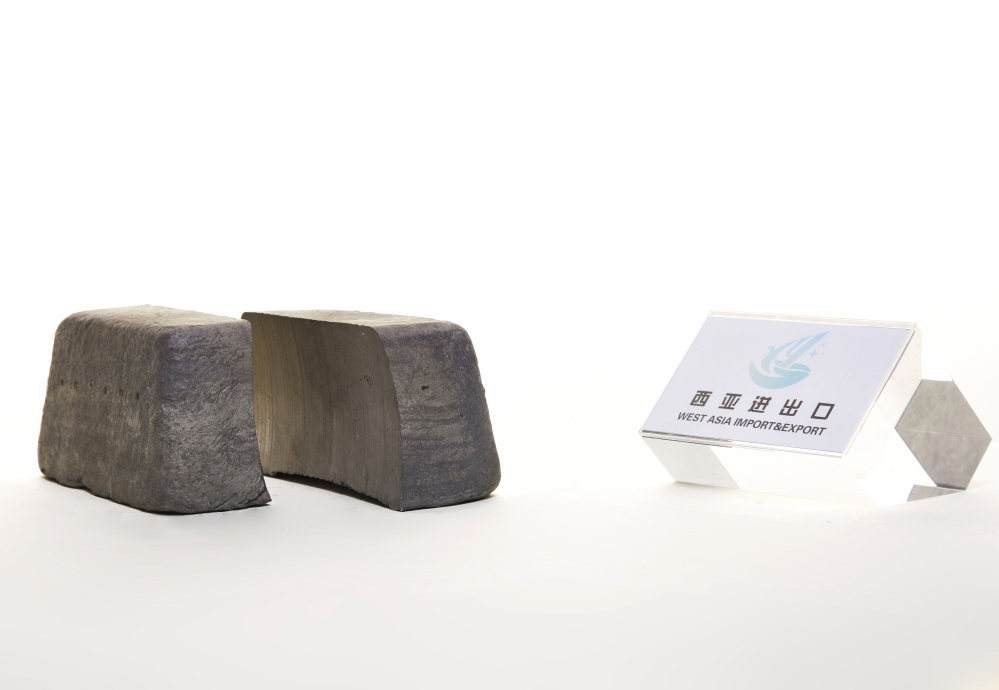

Chromium Ore Market Analysis

According to the statistics of import and export in West Asia on June 25, the price of chrome ore futures continued to drop sharply this week by 10-15 US dollars/ton CIF, and the spot price remained weak and stable. Due to the sluggish demand for terminal stainless steel, the retail price of downstream ferrochrome has not been spared. This week, the price of high-carbon ferrochrome has been lowered again by $6.9-13.8/50 basis tons. The confidence of domestic chromium-related people in the short-term market outlook is weak, and chrome ore importers are still in a state of waiting and not operating. Without the support of domestic procurement, foreign companies began to lower their quotations to cater to the domestic market.

1. Spot price of chrome ore

This week, the spot price of Zimbabwe chrome ore at Tianjin Port was lowered by $0.14/ton. Although the South African chrome ore futures prices fell before the festival, spot suppliers were not willing to ship at low prices due to the increased cost of the depreciation of the RMB against the US dollar. Superimposing the recent arrival of chrome ore futures to Hong Kong, most of the factories are the main ones. On the one hand, due to the relative concentration of resources, the spot prices at the port are relatively high, and on the other hand, the willingness to purchase high-quality factory spot goods is not strong.

2. Brief introduction of chrome ore transaction

Although the operating rate of domestic factories is gradually increasing, and the overall demand for chrome ore is also gradually increasing, but because alloy factories have poor expectations for the market outlook and lack confidence, and most alloy factories have arrived in Hong Kong in advance, the desire for spot purchases and stocking is currently low. Even if there is a procurement demand, it is mainly based on buy-and-use.

According to the current iron price calculation, most of the alloy factories in the southern region are in a state of loss, and the alloy factories that still maintain production are mainly aimed at consuming port inventory and fulfilling orders from steel factories, and have basically no intention of purchasing chrome ore.

3. Downstream market of chrome ore

Price of ordinary silicon and high chromium (USD/50 basis tons, ex-factory with tax in cash):

Southwest 1.62/Lb/Cr-1.65/Lb/Cr;

Northwest 1.62/Lb/Cr-1.64/Lb/Cr;

Northeast 1.7/Lb/Cr-1.68/Lb/Cr;

East China 1.65/Lb/Cr-1.68/Lb/Cr;

Central China 1.65/Lb/Cr-1.7/Lb/Cr;

North China 1.62/Lb/Cr-1.65/Lb/Cr:

Low silicon and high chromium (1.0<Si<1.5): 1.71/Lb/Cr-1.72/Lb/Cr.

This week, the price of high-carbon ferrochromium has been lowered again by US$6.9-13.8/50 basis ton, and so far the current round of decline has reached 48.34-55.25 yuan/50 basis ton. At the beginning of the week, the ore price continued to fall back to provide profit-making conditions for factories, and the performance of the consumer side was weak, which led to the strengthening of bearish expectations for July bidding prices, and the retail market of high-carbon ferrochrome was light. The price of coke in the middle of the week stopped falling and rebounded slightly, but the effect of boosting the market was very limited. Costs rose and fell, market information was intertwined with pros and cons, and the Dragon Boat Festival was affected by the small and long holiday. A round of steel moves landed.

.png)

4. Chrome ore futures market

Chromium ore external transaction price: South Africa 40-42% concentrate 285-290, 42-44% concentrate 315-320, South Africa 36-38% lump ore 245-250, 40-42% raw ore 275-280 (USD/ton CIF), Turkey 46-48% fine powder 365-370, Turkey 40-42% lump ore 305-310, Pakistan 40-42% lump ore 300-305, Albania 40-42% lump ore 315-320, Oman 34- 36% lump ore 215-220, Zimbabwe 48-50% concentrate 390-395 (USD/ton CIF).

This week, chrome ore futures were lowered by US$10-15/ton. As the price of chrome ore in South Africa fell, the purchasing enthusiasm of alloy factories did not increase. The main reason was that the factories were worried about the reduction of high chromium prices in the future market, and the price of chromium ore continued to fall due to insufficient support. Due to the low purchasing sentiment in China's chrome ore market, futures quotations from various countries have also been adjusted back one after another. However, chrome ore importers try to reduce futures imports or suspend operations. Currently, the external transactions are mainly purchased by factories or "back-to-back" transactions. The transactions in South Africa are mainly concentrated in the 40-42% chrome concentrate in the northern market. The production costs of factories in the south are upside down, and they are very cautious about futures purchases, so there is no transaction for the size ore yet.

5. Forecast for next week

Due to the weak operation of the downstream high chromium market, factories are more cautious in purchasing chrome ore when making inquiries, especially when a new round of bidding prices is approaching. People in the chromium industry are focusing on the new price guidance market, so it is expected that before the steel bidding price is confirmed, buying and selling The two sides are still mainly on the sidelines. If the steel bidding price is adjusted, the spot price may follow the adjustment range and make a certain concession. In the futures market, some high quotations may not be ruled out due to sluggish transactions, and there is still a certain downward space for the price of particle size chrome ore futures.